Coronavirus, Congress, and Insider Trading

There were reports last week of potential insider trading by members of Congress. Several of them sold millions of dollars in stocks as the coronavirus crisis was just beginning to unfold, before the major stock market decline. At the time, they were receiving regular, confidential briefings on the dangers of the virus. Some were publicly downplaying the severity of the problem while they privately unloaded their stock holdings. But although some of these stock trades may have been deplorable, proving they were criminal would likely be an uphill battle.

The Law of Insider Trading

Insider trading is the purchase or sale of securities based on material, nonpublic information, in violation of a duty of trust and confidence. Classic insider trading involves corporate executives or other company insiders trading their own company’s stock based on nonpublic information, in violation of the duty they owe to their shareholders not to exploit company information for their own private gain. A simple example would be a CEO who knows her company is about to be acquired and purchases large amounts of stock in the company before that information becomes public.

Under the much broader misappropriation theory, an individual is liable for insider trading if he trades stock based on material nonpublic information in violation of a duty owed to the source of that information. In the leading Supreme Court misappropriation theory case, United States v. O’Hagan, the defendant was an attorney whose firm represented the acquiring company in an unannounced takeover bid. He bought large quantities of stock and options in the company that was going to be acquired, and made several million dollars once the deal became public. As an outsider, O’Hagan didn’t owe any duty to the shareholders of that company. But he did owe a duty to his own firm and its client not to misappropriate the client’s confidential information for his personal gain. His trades in violation of that duty thus constituted insider trading.

A key in any insider trading case, therefore, is identifying the relevant duty. Trading on material nonpublic information is only insider trading if using that information for a personal benefit violates a duty the trader owes to someone. If you acquire material, nonpublic information through diligent research and hard work, or even by overhearing two corporate insiders talking on an airplane, it’s not insider trading for you to trade based on that information. There must be a violation of a duty.

The Impact of the STOCK Act

Members of Congress, by the nature of their work, necessarily learn a great deal of information that could impact the stock market. In 2012, in response to concerns about Members profiting off such information, Congress passed the Stop Trading on Congressional Knowledge, or STOCK Act. The Act prohibits Members of Congress and their employees from using information learned during the course of their duties for private profit. It directs the Ethics Committees of both Houses of Congress to issue guidance concerning this prohibition. The Act also states that “Members of Congress and employees of Congress are not exempt from the insider trading prohibitions arising under the securities laws.” The Act specifies that Members and Congressional employees owe a duty “arising from a relationship of trust and confidence” to the Congress and to the American people.

This legislative recognition of a duty is significant for insider trading purposes. As just noted, the existence of such a duty is a prerequisite for insider trading liability. The STOCK Act makes it clear that Members of Congress owe a duty of trust and confidence to Congress and the American people not to personally profit from information they learn in the course of their duties. If Members trade stock in a company based on material, nonpublic information learned through their work, they may be liable for insider trading for breaching that duty.

The Congressional Trades and Insider Trading

The allegation concerning several Members of Congress is that they received nonpublic information during briefings about the Coronavirus and traded stocks based on that information in anticipation of the coming market crash. Not all such transactions involved stock sales; for example, Senator Kelly Loeffler bought stock in a company that specializes in software that allows people to work from home, and other congressional aides reportedly bought stock in companies such as Clorox, Inc.

To prove insider trading, prosecutors would have to establish that these purchases and sales were based on material, nonpublic information learned during the course of Congressional duties. If they were, then the STOCK act makes clear that such transactions for private gain would violate a duty owed to Congress and the American people and therefore would potentially be insider trading. But there are several factors that suggest establishing insider trading could be challenging.

1) Was the Information Truly Nonpublic?

To evaluate any claims of possible insider trading, it is critical to know exactly what information was relayed at the Congressional briefings. Prosecutors would need to show the briefings included information that was not yet public and that would likely lead those who received the information to conclude the stock market is going to decline. Any investigation into these Congressional trades, criminal or civil, therefore would have to explore what exactly the Members were told in these briefings.

There was a lot of public information already floating around about the coronavirus at the time of the briefings in January and February. Were Members really given information that was not otherwise publicly available? Or did the briefings simply serve to educate the Members and try to get them to focus on the problem, without necessarily relying on material nonpublic information?

The answer may vary depending on the briefing. At least some of the briefings reportedly were classified, which suggests a greater likelihood that they contained information not otherwise publicly available. But as to a more routine, unclassified briefing, it may be that any diligent researcher could have readily come up with the same information that was being given to the Members. And if that's the case, then acting on that information would not be insider trading.

2) Was the Information Material?

Even if the briefings contained nonpublic information, that information must have been material. Information is material if it is likely to be deemed important to a person deciding whether to buy or sell the stock. One issue here would be that even if some of the information in the briefings was nonpublic, was it so different from what was already available that it would materially influence anyone’s decision to buy or sell? In other words, there was already so much information available that any additional information received in the briefings, even if not otherwise public, may not have made a material difference to a potential trader. Was there actually something disclosed in the briefings that was both nonpublic and so dramatically different from the other available information that it would have tipped the scales on whether to buy or sell?

Another wrinkle when it comes to materiality is that this information likely did not relate to any particular company, or even any particular industry, but to the risks to the country and economy as a whole. Insider trading cases usually involve nonpublic information that relates directly to the stock that was traded. Charging insider trading based on information suggesting that the overall economy in general is going to decline would be unusual. Even if there is information suggesting that the economy as a whole might suffer, how does one prove that information was material to the stock price of any one company? You could try to argue that certain industries seemed more likely to suffer or to profit, and focus on trades based on those industries (such as sales of hotel or airline stocks), but it still could be challenging to prove materiality as to any particular trade.

Once again, what was said at the briefings could be key; for example, if a briefing focused specifically on likely damage to the airline industry, that might support allegations of subsequent insider trading in airline stocks. But if a briefing was focused more on the overall health risks to the country and less on the economic impact, then proving the materiality link to trading stock in any particular company could be much more challenging.

3) Were the Trades Actually Based on the Information Received?

Another possible defense would be that even if there was nonpublic information provided during the briefings, the trades were not based on that information. In the wake of the insider trading allegations, Senator Richard Burr put out a statement claiming his trades were based only on public information, such as reports on CNBC. Burr is claiming, in other words, that even if he received nonpublic information, his trades were based not on that information but on other information that was widely available to the general public.

If there was material, nonpublic information provided at the briefings, then it likely will not be enough for Burr just to claim he relied on other, public information when making the trades. Under SEC Rule 10b5-1, if a person possesses material, nonpublic information at the time of a purchase or sale of a security, there is a presumption that the trade was based on that information. The purchaser can rebut that presumption, but only by showing that there was a pre-existing, written plan or order to sell the stocks that predates the receipt of the nonpublic information. Absent such a pre-existing order, a Member or staffer will be presumed to have relied upon any material nonpublic information received when making a trade.

A related issue will be whether the Member or other individual who received the information actually ordered the trades in question. Senator Kelly Loeffler, for example, has claimed on Twitter that she does not make decisions about her stock trades and that those decisions are made by third-party advisors without her input. Senator Diane Feinstein has claimed that her stocks are held in a blind trust and that this particular trade was made in her husband's account, and so any trades were made without her knowledge or participation. If trues, these would be defenses to any claim of insider trading.

One question raised by Senator Loeffler’s defense is whether she had any communications with those “third party advisors” where she shared information learned during the briefings. She may not make the decisions herself, but if she passed along material, nonpublic information and her advisors traded on that information then she could still be liable for insider trading as a “tipper” or for aiding and abetting. The same would be true if she passed the information to her husband, who happens to be Chairman of the New York Stock Exchange, and he then relied on that information to trade or to direct others to trade on their behalf.

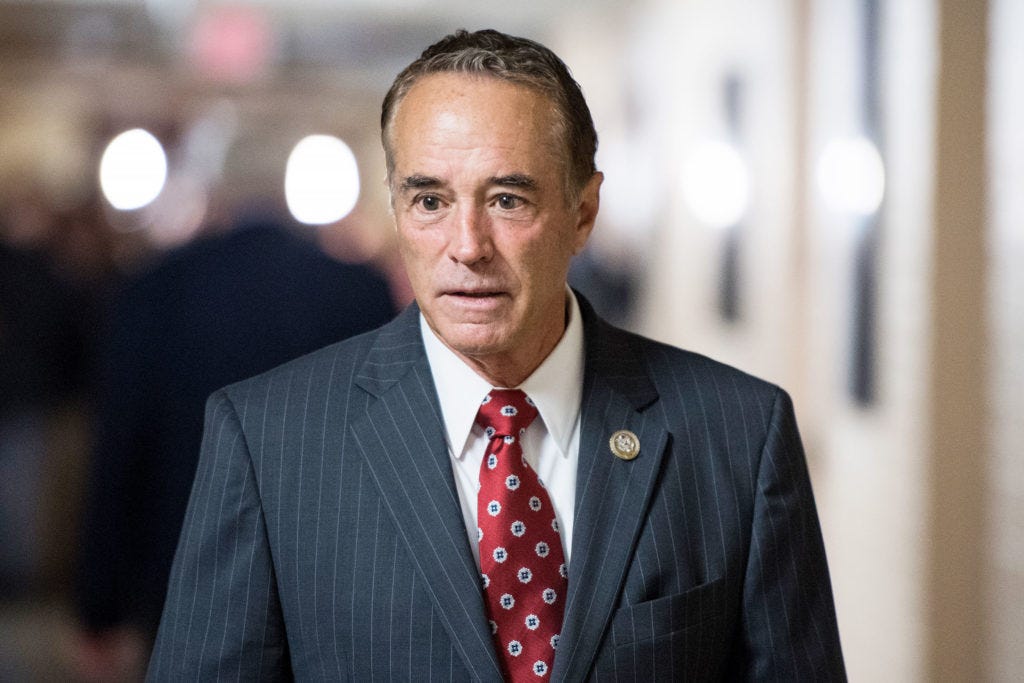

The Case of Representative Chris Collins

These allegations have led some to compare these Members of Congress to Representative Chris Collins, who was recently sentenced to 26 months in prison for insider trading. But the cases have almost nothing in common. Collins served on the board of a pharmaceutical company and sold stock in that company after receiving confidential information from the board chairman that a major drug trial had failed. The Collins case differs from these current allegations in two important respects. First, the inside information Collins gained was not as a result of his work on Capitol Hill. His status as a Congressman was irrelevant to his insider trading case, as was the STOCK Act. Collins could have been just any board member, trading on confidential information received from the chairman. And second, the information Collins received was specific to the one company in whose stock he subsequently traded – it wasn’t information about a potential overall market decline.

The Appropriate Remedy

These stock trades deserve to be investigated. Some certainly seem to violate the spirit of the STOCK Act. But given the issues described above, it seems unlikely that any will result in a criminal case. And a criminal remedy is not necessarily the answer; there are many possible consequences for these actions besides a criminal prosecution. The SEC may pursue civil insider trading charges, where the penalties may include fines and disgorging of profits. Other shareholders in companies that were dumped may sue for civil stock fraud. The Ethics Committees can explore the allegations and impose sanctions as well; Senator Burr, for example, has already requested an Ethic Committee investigation of his own stock trades. Members of Congress could face calls to resign, as some already have. And of course, voters have the ultimate political sanction at the ballot box for any offenders who run for re-election.

One good outcome would be for this scandal to lead to reforms that include a requirement that every Member of Congress hold their stocks and other assets in blind trust, with absolutely no control over investment decisions. Until that is the norm, allegations like this will continue to arise and there will always be suspicions that some Members are using the power of their office unfairly to line their own pockets. Such conduct may not always be criminal, but it's always wrong.