The McAfee Cryptocurrency Fraud Case

Tech celebrity John McAfee and his former bodyguard and business associate Jimmy Watson, Jr. were indicted last week on fraud and money laundering charges. The indictment alleges that in 2018 the two engaged in a series of fraudulent schemes related to investments in cryptocurrencies, taking in more than $13 million. The charges highlight the ability of alleged fraudsters to adapt old-school techniques to new technologies. As the McAfee fraud case demonstrates, when it comes to fraudulent schemes, the classics never grow old.

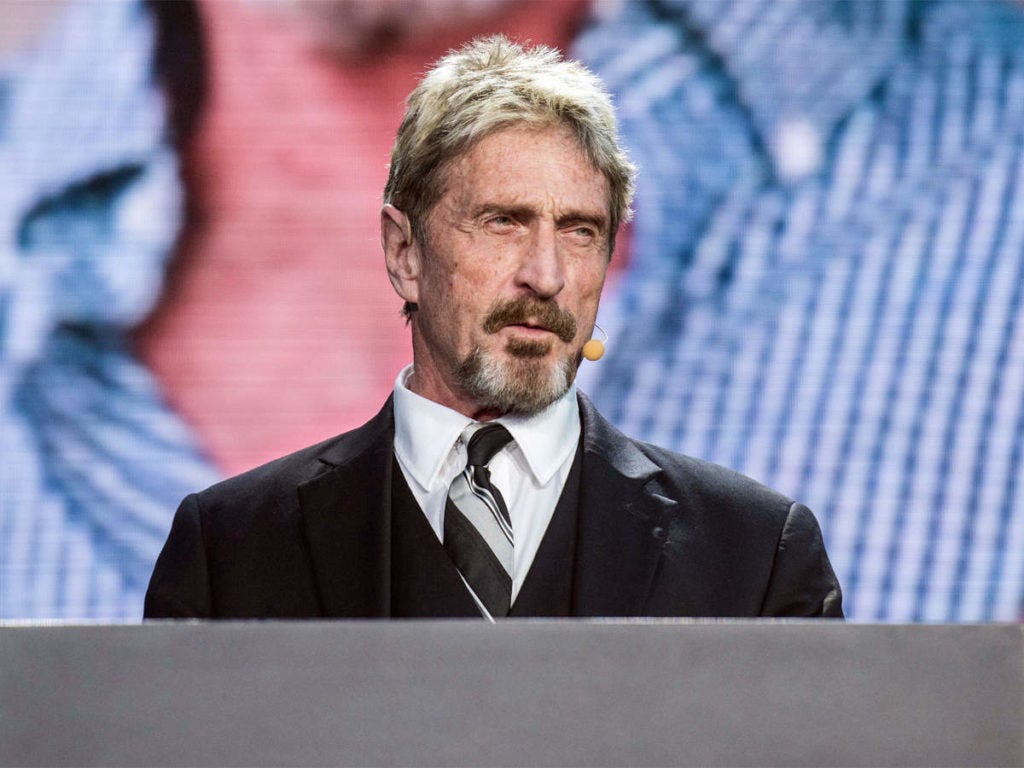

The Defendants

John D. McAfee is a 75-year-old American citizen who was born in the U.K. He is best known for creating the computer antivirus software and company that still bear his name. Since selling his company, McAfee has been a popular figure at tech industry conferences and on various media platforms such as YouTube and CNBC. He has cultivated an image as an expert in cryptocurrency and cybersecurity. Of particular relevance to the criminal case, at the time of his alleged crimes his official McAfee Twitter account had more than 750,000 followers.

The co-defendant Jimmy G. Watson Jr. is forty years old and a former Navy Seal. At the end of 2017 he began working for McAfee as a private security guard, and later became his “Executive Advisor.” McAfee had a team of people working for him on cryptocurrency investments, and Watson ultimately became a leading member of that team.

Cryptocurrency: Bitcoin and Beyond

Cryptocurrencies, or digital currencies, are electronic representations of value that operate like traditional coin or paper currencies. They can be used as a medium of exchange to make purchases or investments, and may be traded back and forth among individuals. The issuance and exchanges of cryptocurrencies are tracked in digital ledgers known as blockchains. Unlike more traditional currencies, cryptocurrencies are not issued by, or backed by, any government. Ultimately they depend for their value on the agreement and faith among those who use them.

The best-known cryptocurrency is bitcoin, which has been extremely volatile and, for many of its investors, extremely lucrative. It has undergone a number of boom and bust cycles, but the overall trend is hard to ignore: a single bitcoin that was worth less than a dime in 2010 is worth more than $54,000 at this writing (of course, by the time you read this, it could be worth twice that – or half).

Returns like that inevitably attract attention. Many companies and individuals have launched their own cryptocurrencies, with varying degrees of success, and several thousand are now available on the market. Cryptocurrencies other than bitcoin are often referred to as “altcoins.” Startup companies use an “initial coin offering” or “ICO” – similar to an initial public offering or IPO – to raise funds by issuing and selling the digital tokens in their new altcoins.

Returns like that also inevitably attract the interest of government regulators and law enforcement. The government alleges in the indictment that certain uses and aspects of digital currencies qualify them as commodities under federal law, making trading in them subject to regulation by the Commodity Futures Trading Commission. The indictment also alleges that in some cases cryptocurrencies qualify as securities subject to federal securities law and regulation by the Securities Exchange Commission. More broadly, just last October the Attorney General's Cyber-Digital Task Force released a detailed report, "Cryptocurrency Enforcement Framework," analyzing multiple law enforcement issues related to the rise of cryptocurrencies.

The Fraud Schemes

The indictment charges that McAfee, with the help of Watson and other unnamed co-conspirators, engaged in two different types of fraud schemes involving altcoins. The first was what is known as a “pump and dump” or “scalping” scheme. McAfee would direct his team members to purchase large quantities of a particular altcoin, either in his name or on his behalf. After the purchases, McAfee would endorse that altcoin on his official Twitter account and encourage others to invest in it (the “pump”) without disclosing that he owned large amounts of it himself. When the price rose based on the interest and activity created by his endorsements, McAfee and his team members would sell their holdings (the “dump”). This often left those who invested based on his recommendations holding the bag, as the value of the altcoin would drop significantly over time once McAfee stopped endorsing it.

McAfee allegedly pumped and dumped a number of altcoins this way, using his Twitter account to promote a “coin of the day” or “coin of the week”. McAfee’s Tweets allegedly contained false and misleading statements about the investments and did not disclose his true reason for the endorsement: to run up the price so he could sell. He also allegedly repeatedly lied when asked on Twitter and elsewhere whether he was pursuing his personal financial interests, and denied owning the altcoins he was promoting.

The indictment charges that in December 2017 and January 2018, the defendants and other McAfee team members earned more than $2 million through pump and dump schemes involving twelve different publicly-traded altcoins.

The indictment also charges a second, more lucrative scheme, the “IPO touting scheme.” It alleges that over about a three-month period in late 2017 and early 2018 the defendants and other McAfee team members promoted at least seven ICOs on Twitter. As compensation for these promotions, the McAfee team received more than $11 million worth of bitcoin and other cryptocurrencies from the ICO offerors. In each case, McAfee allegedly failed to disclose to the ICO investors that a substantial portion of the funds raised by the ICO he was promoting would be paid to McAfee. The indictment also alleges that the defendants took active steps to conceal their compensation arrangements from the ICO investors.

Criminal Charges in the McAfee Fraud Case

The indictment uses several different theories to charge the two schemes:

Count 1: Conspiracy to commit commodities and securities fraud (pump and dump scheme)

Count 2: Conspiracy to commit wire fraud (pump and dump)

Count 3: Wire fraud (pump and dump)

Count 4: Conspiracy to commit securities fraud (touting scheme)

Count 5: Conspiracy to commit wire fraud (touting)

Count 6: Wire fraud (touting).

Finally, Count 7 charges conspiracy to commit money laundering under 18 U.S.C. § 1957. Unlike money laundering charges under the more commonly charged section 1956, section 1957 does not require proof of any intent to disguise or conceal the nature and source of the funds or any other specific purpose for the laundering transaction. It may be violated simply by taking criminal proceeds and depositing them in the bank, so long as the transaction exceeds $10,000. The indictment alleges that the defendants did this with the proceeds of the touting wire fraud alleged in Count 6.

Most of the criminal charges carry a maximum penalty of 20 years in prison. The conspiracy charges in counts 1 and 5 carry a maximum penalty of 5 years, and the money laundering count carries a maximum penalty of 10 years.

The indictment also seeks forfeiture of the money earned through the schemes or of any assets whose purchase can be traced to those proceeds.

Possible Defenses

As in many white collar cases, it appears the facts of the case will be largely undisputed. There will be a substantial paper trail to prove the investments that McAfee and his team made, their Twitter endorsements, what was and was not disclosed, what they earned, and what they did with the money. So any defense likely will be not “we didn’t do it” but rather “it wasn’t a crime.”

A key legal issue will be whether these transactions were in fact subject to federal securities or commodities regulation. Watson’s attorney hinted at this kind of defense when the indictment was announced, suggesting there would be a dispute over whether cryptocurrencies are securities, commodities, or something else. If the court determines they do not legally qualify as securities or commodities, the criminal charges would fail.

The cryptocurrency craze erupted relatively quickly over the past decade and there has been considerable uncertainty over the regulatory status. Cryptocurrency markets have had a “wild west” feel to them and the government has been slow to respond. SEC leaders have said in recent speeches that they do not consider bitcoin itself to be a security. But the SEC has not been reluctant to pursue civil actions related to ICOs in new cryptocurrencies under specific factual circumstances. Suffice it to say that the legal status of cryptocurrencies is still somewhat up in the air, and that status may depend a great deal on the facts of a particular offering or transaction.

The McAfee indictment is full of hedges in this regard. It says that “certain uses and aspects of digital currencies qualify them as commodities” and that “in certain circumstances, digital assets can also qualify as securities.” Although the indictment confidently asserts that these particular transactions were subject to federal jurisdiction, the language of the indictment itself appears to recognize this is a gray area. This case may lead to a judicial determination concerning the status of cryptocurrencies that could have much wider implications.

Twitter Cryptocurrency Fraud: Old Wine in New Bottles

At the press conference announcing the indictment, FBI Assistant Director William F. Sweeney, Jr. said the case involved an “age old pump-and-dump scheme.” It’s true that, despite the glitzy new technologies involved, the alleged schemes in the McAfee fraud case involve old, tried-and-true fraud techniques. And there are several characteristics of the cryptocurrency markets that make them prime candidates for these kinds of classic schemes.

The first is the complex and confusing nature of the product. Many, if not most, people probably don’t have a clear understanding of what exactly a cryptocurrency is, how it works, or why it has any value at all. That makes the area ripe for fraud. One hundred years ago, when pioneering the type of fraud scheme that still bears his name, Charles Ponzi relied on obscure instruments known as postal reply coupons and claims about international variations in currency and postal rates – difficult things for the typical 1920s investor to understand or verify. If an investment is difficult to understand, it makes it easier for potential fraudsters to deceive people about that investment.

Related to the obscure nature of the investment is the ability of a celebrity or other well-known figure to attract investors – or in this case, victims. Many watching the frenzy in cryptocurrencies likely wanted to get in on the action but felt uncertain about which altcoins might be good investments. If a tech leader with McAfee’s stature throws his name behind a particular coin, that will attract many who feel unqualified to evaluate the investment for themselves. That, of course, is why some of the IPO issuers were willing to pay McAfee such huge sums of money for his endorsement.

Another “high tech” feature that makes this case interesting is the role of Twitter. Virtually all of McAfee’s promotions and endorsements in furtherance of the alleged schemes took place on Twitter. We’ve seen how that social media platform transformed political communications in the hands of former president Trump and other users with large numbers of followers. The same characteristics that make it so easy to spread “fake news” when it comes to politics also make it easier to tout fraudulent investments. Twitter has a massive reach but is largely unregulated, making it easy to spread phony information to millions.

Something like a pump-and-dump scheme operates much more efficiently in the age of Twitter. In the days before digital communications, those engaging in such a scheme might have to print a newsletter or other document touting the stock in question and deliver it by mail. That involves printing and postage expenses and takes much more time. In the digital age a potential fraudster can reach hundreds of thousands of people in an instant. Technology makes everyone’s job easier – including criminals'.

The final characteristic of cryptocurrencies that McAfee apparently was able to exploit is the investment frenzy surrounding them. When people see the astounding returns in something like bitcoin they want to get in before they miss out – and that can cause people to let down their guard. Some have compared the frenzy surrounding bitcoin to the famous Dutch tulip mania in the 1700s, the first great investment bubble. If you read some of the online commentary about altcoins on sites like Reddit or Twitter, much of it has almost an evangelical tone. This is not only a warning sign of a potential bubble – it also creates an environment where criminals can prey on those caught up in the frenzy.

What to Watch

McAfee is currently in custody in Spain, awaiting extradition. He was arrested there several months ago on federal tax evasion charges filed in a separate case in Tennessee. In the meantime, he continues to take to Twitter, now to defend his conduct and attack the government's case.

Watson has been arrested on the criminal charges. In addition to the criminal indictment, both men are also facing civil charges from the CFTC and SEC.

The McAfee fraud case should be a cautionary tale for investors eager to jump on the latest hot bandwagon based on celebrity endorsements. And it could be a sign of things to come as the federal government, under the Biden administration, seeks to flex its muscles when it comes to policing the cryptocurrency markets.

Like this post? Click here to join the Sidebars mailing list